tax shelter real estate definition

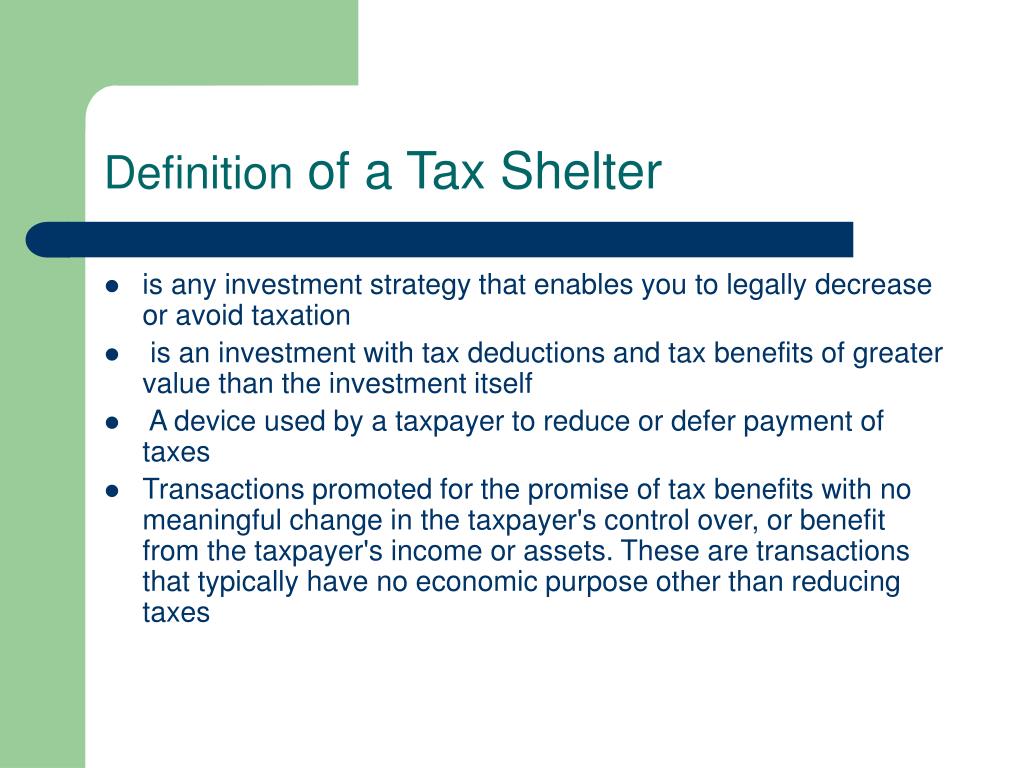

There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. A tax shelter is a means of minimizing tax liability.

What Is A Tax Shelter And How Does It Work

Aside from the attempts to stop tax shelters in the United States through provisions of the US.

. The ready to use real estate property has two phases under construction and the. Real Estate Tax Shelters Lower Taxes Through Depreciation. How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector.

The most widely used tax shelter in the US is the 401k. An investment vehicle that reduces ones tax liabilityFor example a 401k defers taxation until withdrawal from the account and may therefore be considered a tax shelter. Turning back to Merriam-Webster a tax shelter is defined as.

Tax shelters are ways individuals and corporations reduce their tax liability. Best Value on the Market. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake.

Fundrise - 23 Returns Last. Tax Shelter Law and Legal Definition. See Regulations section 1448-2 b 2 iii B 2 TD 9942 PDF for.

The election is valid only for the tax year for which it is made and once made cannot be revoked. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. It is a legal way for individuals to stash their money and.

One of the tax shelters is to invest in real estate but in reality each real estate is a separate entity on its own. Updated for 2020 Regulations. 25 to file your taxes.

Risk Free Pass Guarantee. A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man. The failure to report a tax.

The abusive tax shelter is a type of investment that is considered illegal as it allegedly diminishes the income tax liability of an investor without affecting the investors income or their assets. Tax shelters have therefore often shared an unsavory association with fraud. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any.

Tax shelters can be both legal illegal. Shield Your Profits with a 1031. Many people think of tax shelters negatively but they are completely legal and.

90-Day Access to Our Testing Materials. The term tax shelter means. Allowable Rental Property Tax Shelter Deductions.

A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

448a3 prohibition defines tax shelter at. 250 Sample Real Estate Exam Questions. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year.

Definition of Abusive tax shelter. An entity such as a partnership or investment plan formed with tax avoidance as a main purpose. The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business.

To be a tax shelter the investment has to lose money. A number of real estate tax shelter exist. When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have.

Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

Tax Shelter Difference Between Tax Shelter And Tax Evasion

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

Using Your Real Estate Investments As A Tax Shelter

Tax Shelters For High W 2 Income Every Doctor Must Read This

What Are Tax Sheltered Investments Types Risks Benefits

Tax Shelters Definition Types Examples Of Tax Shelter

Cash Accounting Method Unlocked Dallas Business Income Tax Services

Tax Shelters For High W 2 Income Every Doctor Must Read This

Tax Shelters For High W 2 Income Every Doctor Must Read This

What Does The Irs Do And How Can It Be Improved Tax Policy Center

What Is The Definition Of Tax Shelter Business Interest Expense

What Are Tax Sheltered Investments Types Risks Benefits

Tax Shelters For High W 2 Income Every Doctor Must Read This

Income Debt And Federal Tax Shelters

Ppt Tax Shelter Powerpoint Presentation Free Download Id 69636

Tax Havens Current State Pros And Cons By Maria Gabriela Calderon Arnaldo Busutil And Anturuan Stallworth April 12 Ppt Download

/dv740090-5bfc2b8b46e0fb00265bea71.jpg)